American Express Credit Cards – Link

American Express has released a new limited time offer on the Business Platinum Card from American Express! (Learn How To Apply Here) Terms Apply.

American Express has released a new limited time offer on the Business Platinum Card from American Express! (Learn How To Apply Here) Terms Apply.

With this limited time offer, you can earn up to 100,000 bonus Membership Rewards points! You’ll earn 50,000 Membership Rewards points after you spend $10,000, and another 50,000 points after you spend an additional $15,000. Spending must be done within 3 months to receive the bonus.

In terms of earning for purchases, you’ll be getting 5 points for every dollar on flights and hotels booked via AmexTravel.

1.5 points per dollar when you make a purchase of $5,000 or more. Up to a limit of 1 million additional points per year, and 1 point per dollar on all other purchases.

This card will also give you 35% back in membership reward points, when you register for an airline and use your points to pay for all or part of a flight with that airline, via AmexTravel! You can earn up to 500,000 bonus points this way, per calendar year. This is obviously a great perk!

For instance, let’s say you want to book a $1,000 plane ticket, which will be 100,000 points. Amex will give you back 35,000 points, making the final cost of your $1,000 ticket, only 65,000 points!

This is if your using your points for paid tickets. Alternatively, you can of course transfer your points out to any of the many American Express airline and hotel partners and book using miles the traditional way.

Other benefits include:

- $200 in annual statement credits for spending at Dell. You’ll get $100 for January-June and another $100 for June-December. Enrollment required.

- Get one year FREE of Platinum Global Access from WeWork, a $2700 value!. With this membership, you are entitled to free access to 300+ WeWork workspaces in 75+ cities around the world. Enrollment required. View all locations here.

- $200 Airline Fee Credit for incidental fees. This credit is per calendar year! This means, for instance, if you get this card now, you’ll get $200 back in incidental fees from now until the end of 2019, and then another $200 in credits starting in January of next year. This means you can get a total of $400 in credits all within your first year of card-membership!

- $85-$100 Global Entry or TSA Pre check application fee credit

- Free lounge access worldwide at hundreds of lounges through Priority Pass

- Free Centurion lounge access

- Free Delta Sky Club access, if you have a same day Delta boarding pass

- Free Airspace lounge access

- Free elite Gold status at Marriott and Hilton

- Business Platinum Card Concierge Services

- No Foreign Transaction fees

- Premium Roadside Assistance, which gives you services such as towing up to ten miles, jump starts, flat tire changes, lockout service, all free up to 4 times per year.

- Exclusive discounts at Hertz and National rental car, and a free 4 hour late return grace period at Hertz.

- You’ll also get Amex’s second to none credit card insurances, which include: Return Protection, Purchase Protection, Extended Warranty, Dispute Resolution, Baggage Insurance, and more!

There is a $595 annual fee that comes with this card, though the 100,000 bonus points and all the many benefits and credits, make it more than worth it.

Keep in mind that this is a business credit card. You do not need to be incorporated though, or have a business in the traditional sense to apply for a business credit card. If for instance you sell on ebay, or even if you have any other side business (and you want to keep your expenses separate), you are eligible to apply for a business credit card. When filling out the business credit card application, choose “Sole Proprietor” as the type of business and fill in your name as your business name. For the Tax I.D. you will write your Social Security Number.

You do not need to have any revenue yet from your business to be eligible for a business credit card.

Additionally, one of the befits of a business credit card, is that on a business credit card, your balance is not reported on your personal credit report. That’s a nice perk, being that a whopping 30% of your credit report is made up of your credit utilization.

Learn How To Apply Here

Opinions, reviews, analysis & recommendations are the authors alone and have not been reviewed, endorsed or approved by any of these entities.

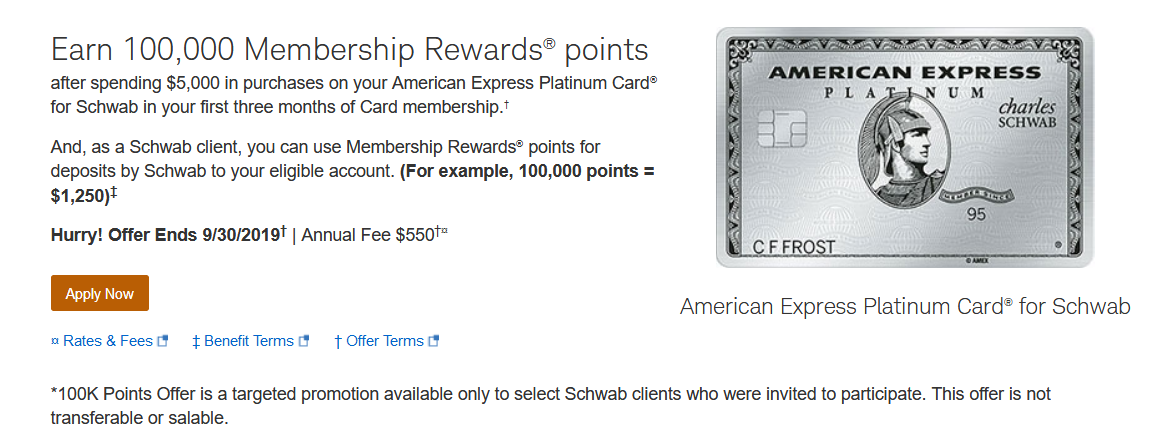

There is a rumor going around, which seems to be highly plausible, that the signup bonus on the Starwood Preferred Guest® Credit Card from American Express, will be very shortly, substantially lowered to just a $200 statement credit, if not outright discontinued, so this may be your last chance!

There is a rumor going around, which seems to be highly plausible, that the signup bonus on the Starwood Preferred Guest® Credit Card from American Express, will be very shortly, substantially lowered to just a $200 statement credit, if not outright discontinued, so this may be your last chance!