Are you looking for a specific deal or need help choosing the right credit card? Send us an email! Questions, Comments or Requests are welcome! You can send us an email at requests@ old1.www.dealsmaven.com, you can contact us HERE or you can just leave a comment below.

Updated June 14th Originally posted may 19th

“Dear DealsMaven,

Before I go grocery shopping I always checkout the coupon tab on your site. I was wondering if there was also a way to maximize my grocery savings with credit cards?”

You bet! There are many credit cards which offer more points or cash back for grocery shopping.

Below is a list of the best credit card for groceries,

Update: The below offers are expired.

The American Express Blue Cash Preffered – This card offers a whopping 6% cash  back at grocery stores. Though, that’s only on the first $6,000 afterwards it’s only 1% cash back. Now, if you generally spend less than $6,000 a year at grocery stores, you can maximize your cash back by purchasing gift cards, either to that grocery store or — many times supermarkets carry merchant gift cards such as to Amazon etc; — you can purchase merchant gift cards where essentially you will be receiving 6% cash back at these merchants too. If you spend more than $6,000 a year on groceries you can first max out the 6% on this card (that’s $360 cash back!) and then use one of the other credit cards listed below.

back at grocery stores. Though, that’s only on the first $6,000 afterwards it’s only 1% cash back. Now, if you generally spend less than $6,000 a year at grocery stores, you can maximize your cash back by purchasing gift cards, either to that grocery store or — many times supermarkets carry merchant gift cards such as to Amazon etc; — you can purchase merchant gift cards where essentially you will be receiving 6% cash back at these merchants too. If you spend more than $6,000 a year on groceries you can first max out the 6% on this card (that’s $360 cash back!) and then use one of the other credit cards listed below.

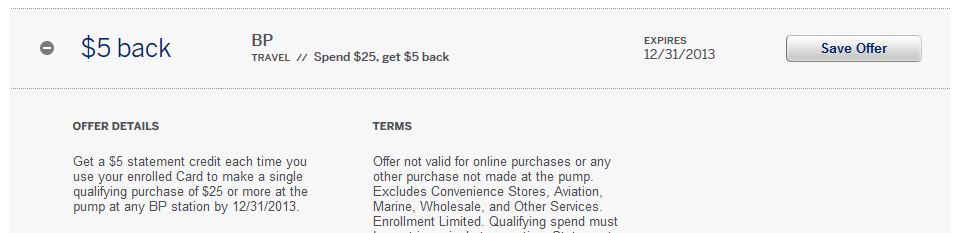

Another benefit of this card is you earn an unlimited 3% cash back on gas purchases and at select merchants, additionally, you’ll receive 1% cash back on all other purchases. Again, many gas stations sell merchant gift cards and you can maximize this perk by purchasing merchant gift cards at these gas stations. This card also has a 0% APR for the first 12 months.

This card normally comes with a $150 statement bonus after you spend $1,000 within the first 3 months. There is currently though an offer for a $250 statement bonus for spending $1,000 within the first 3 months.

There is a $75 annual fee on this card. Even if you do not want a credit card with an annual fee it may be still worth it to get, being that you’ll either get a $150 or $250 bonus making the $75 fee worth it, also, if you spend alot on gas and groceries the $75 pays for itself. If you do not want to continue paying for this card after the first year is up, you can downgrade to the no annual fee version called the American Express Blue Cash Everyday (see below) or you can simply cancel you card.

American Express Blue Cash Everyday – This card offers 3% cash back at grocery  stores. The 3% cash back is only on the first $6,000 afterwards it’s only 1% cash back. You can maximize the cash back the same way as was written earlier.

stores. The 3% cash back is only on the first $6,000 afterwards it’s only 1% cash back. You can maximize the cash back the same way as was written earlier.

Other benefits of this card is an unlimited 2% cash back at gas stations and NO ANNUAL FEE.

American Express Premier Rewards Gold Card – This credit card gives 2 points f or every dollar spent at supermarkets.

or every dollar spent at supermarkets.

Other benefits are, 3x Points on Airfare & 2X Points at US gas stations 1 point everywhere else. Also, the sign-up bonus on this card is “currently” 25,000 points after spending $2,000 during your first three months of Card membership; Additionally, you’ll earn 15,000 points after you spend $30,000 in one calendar year. I write “currently” because many times there is a promotion on this card for 50,000 points.

Another thing about this card, is unlike the other credit cards mentioned, this card’s points can be transferred into hotels and airline miles which depending on how you redeem them, can many times be more lucrative than 3-4% cash back you’d receive on the other cards. The downside of this card though is you’d need to do ALOT of spending to justify the steep $175 annual fee, but of course after the FREE first year is up you can just cancel your card. Just make sure to transfer out your points before you cancel the card. To see the hotel and airline transfer options click here

This card has an annual fee of $175 which is WAIVED for the first year.

PenFed Platinum Rewards – This card offers an unlimited 3 points per dollar spent at supermarkets.

Other benefits of this card are 5 points per dollar on gas purchases and 1 point everywhere else. Also, don’t forget you can maximize your cash back with buying gift cards.

No annual fee.

BankAmericard Privileges – This card offers 2% cash back on groceries and 3% on gas for the first $1,500 in combined gas and  grocery purchases each quarter. Now, if you have a Bank of America checking or savings account, if you choose to redeem your cash back by depositing the money into you account, you will receive an additional 50% on everything you earn essentially making it 3% cash back for groceries and 4.5% cash back on gas.

grocery purchases each quarter. Now, if you have a Bank of America checking or savings account, if you choose to redeem your cash back by depositing the money into you account, you will receive an additional 50% on everything you earn essentially making it 3% cash back for groceries and 4.5% cash back on gas.

This card comes with a $100 cash rewards bonus if you make at least $500 in purchases in the first 90 days.

This card has an annual fee of $75 which is WAIVED for the first year or if you have a balance of at least 50k in you Bank of America accounts.

BankAmericard Cash Rewards – This card offers 2% cash back at supermarkets, as  well as 3% cash back at gas stations, though it’s only the first $1,500 in combined gas and grocery purchases each quarter. You’ll earn 1% cash back everywhere else.

well as 3% cash back at gas stations, though it’s only the first $1,500 in combined gas and grocery purchases each quarter. You’ll earn 1% cash back everywhere else.

Other benefits are, earn a 10% customer bonus when you redeem your cash back into a Bank of America checking or savings account. Additionally, you’ll get a $100 cash back bonus after you make at least $500 in purchases within 90 days of account opening and a 0% APR for your first 12 billing cycles for purchases. This card does NOT have an annual fee.

Barclaycard Arrival World MasterCard – This credit card doesn’t have any specific  bonus on grocery spending, but it offers a 2% cash back across the board on everything! Additionally, if you redeem your cash back for travel expenses, you’ll get 10% of your redemption back making the cash back for your purchases essentially 2.2%!

bonus on grocery spending, but it offers a 2% cash back across the board on everything! Additionally, if you redeem your cash back for travel expenses, you’ll get 10% of your redemption back making the cash back for your purchases essentially 2.2%!

Other benefits of this card is the mega sign-up bonus of 40,000 points worth at least $400. If you redeem the 40,000 points for travel expenses such as rental cars, hotels or airlines than the $400 becomes $440. Another benefit is that this card also has NO FOREIGN TRANSACTION fees!

Also, unlike the other cards listed, with this card you can buy your groceries ANYWHERE including Costco, BJ’s Wal-Mart etc; and receive 2% – 2.2% cash back. With the other cards you only get the extra cash back at traditional stand alone supermarkets, Costco, Bj’s etc; are not listed as supermarkets, and therefore you don’t get the extra cash back with the other cards.

This card has an annual fee of $89 which is WAIVED for the first year. Again, after the first year is up you can simply downgrade to the no annual fee card or you can just cancel the card.

0,000 bonus points to now 50,000 + 5,000 bonus points when you add an authorized user. You will now receive 50,000 bonus points after spending $3,000 in the first 3 months and an additional 5,000 points when you add an authorized user to your account.

0,000 bonus points to now 50,000 + 5,000 bonus points when you add an authorized user. You will now receive 50,000 bonus points after spending $3,000 in the first 3 months and an additional 5,000 points when you add an authorized user to your account.

Signature credit card.

Signature credit card.

for the first 6 months and 0% interest on balance transfers for the first 18 months.

for the first 6 months and 0% interest on balance transfers for the first 18 months. interest on purchases for the first 12 months.

interest on purchases for the first 12 months.

0% interest on purchases and balance transfers for the first 15 months of cardmembership.

0% interest on purchases and balance transfers for the first 15 months of cardmembership. interest on purchases and balance transfers for the first 15 months of cardmembership.

interest on purchases and balance transfers for the first 15 months of cardmembership. months. There is no annual fee for this card. There are also no late fees with this card.

months. There is no annual fee for this card. There are also no late fees with this card. balance transfers for the first 18 months.

balance transfers for the first 18 months. purchases and balance transfers for the first 12 months.

purchases and balance transfers for the first 12 months. and balance transfers for the first 15 months.

and balance transfers for the first 15 months. Update: This offer is expired.

Update: This offer is expired. Guest (SPG) credit card to 30k bonus points! This credit card normally comes with a 25k bonus. With this offer you will receive 10,000 bonus points after first purchase and an additional 20,000 bonus points after you spend $5,000 within the first 6 months of card opening.

Guest (SPG) credit card to 30k bonus points! This credit card normally comes with a 25k bonus. With this offer you will receive 10,000 bonus points after first purchase and an additional 20,000 bonus points after you spend $5,000 within the first 6 months of card opening.

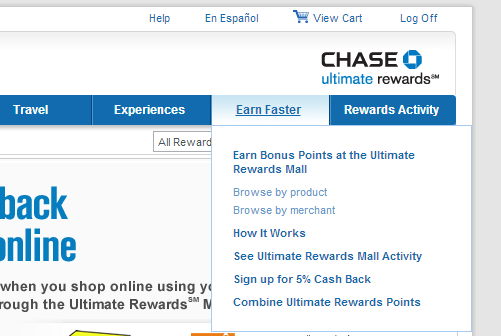

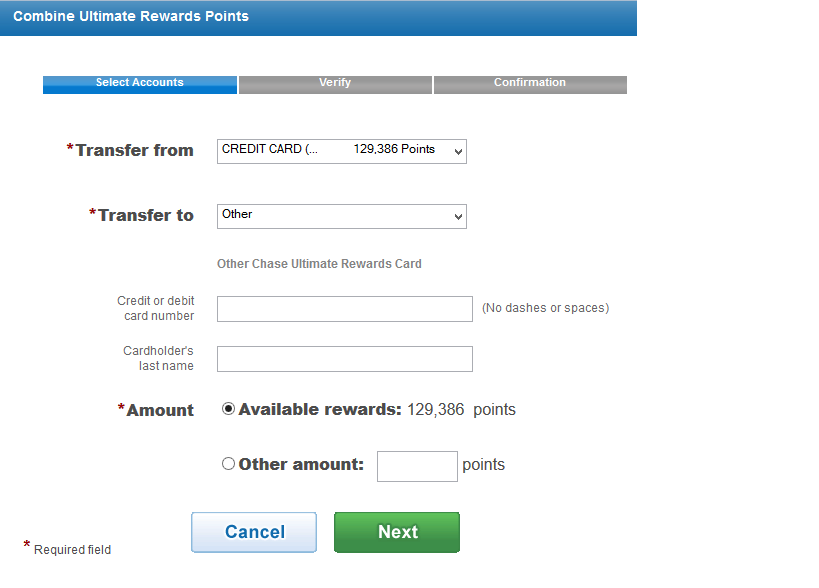

have the option to combine all the accumulated points into one single account.

have the option to combine all the accumulated points into one single account.

Update: This offer is expired.

Update: This offer is expired.

Both the Chase Ink Bold and the Chase Ink Plus are currently offering 60,000 bonus points (usually 50,000 bonus points) when spending $5000 within the first 3 months of card opening. The difference between the “Plus” and “Bold”, is that the “Plus” is a credit card where you can carry a balance and has a credit limit, while the “Bold” is a charge card where you need to pay your balance in full each month and does not have a credit limit.

Both the Chase Ink Bold and the Chase Ink Plus are currently offering 60,000 bonus points (usually 50,000 bonus points) when spending $5000 within the first 3 months of card opening. The difference between the “Plus” and “Bold”, is that the “Plus” is a credit card where you can carry a balance and has a credit limit, while the “Bold” is a charge card where you need to pay your balance in full each month and does not have a credit limit.

back at grocery stores. Though, that’s only on the first $6,000 afterwards it’s only 1% cash back. Now, if you generally spend less than $6,000 a year at grocery stores, you can maximize your cash back by purchasing gift cards, either to that grocery store or — many times supermarkets carry merchant gift cards such as to Amazon etc; — you can purchase merchant gift cards where essentially you will be receiving 6% cash back at these merchants too. If you spend more than $6,000 a year on groceries you can first max out the 6% on this card (that’s $360 cash back!) and then use one of the other credit cards listed below.

back at grocery stores. Though, that’s only on the first $6,000 afterwards it’s only 1% cash back. Now, if you generally spend less than $6,000 a year at grocery stores, you can maximize your cash back by purchasing gift cards, either to that grocery store or — many times supermarkets carry merchant gift cards such as to Amazon etc; — you can purchase merchant gift cards where essentially you will be receiving 6% cash back at these merchants too. If you spend more than $6,000 a year on groceries you can first max out the 6% on this card (that’s $360 cash back!) and then use one of the other credit cards listed below. stores. The 3% cash back is only on the first $6,000 afterwards it’s only 1% cash back. You can maximize the cash back the same way as was written earlier.

stores. The 3% cash back is only on the first $6,000 afterwards it’s only 1% cash back. You can maximize the cash back the same way as was written earlier. or every dollar spent at supermarkets.

or every dollar spent at supermarkets.

grocery purchases each quarter. Now, if you have a Bank of America checking or savings account, if you choose to redeem your cash back by depositing the money into you account, you will receive an additional 50% on everything you earn essentially making it 3% cash back for groceries and 4.5% cash back on gas.

grocery purchases each quarter. Now, if you have a Bank of America checking or savings account, if you choose to redeem your cash back by depositing the money into you account, you will receive an additional 50% on everything you earn essentially making it 3% cash back for groceries and 4.5% cash back on gas. well as 3% cash back at gas stations, though it’s only the first $1,500 in combined gas and grocery purchases each quarter. You’ll earn 1% cash back everywhere else.

well as 3% cash back at gas stations, though it’s only the first $1,500 in combined gas and grocery purchases each quarter. You’ll earn 1% cash back everywhere else.

The full benefits are:

The full benefits are:

British Airways Visa

British Airways Visa  Marriott Rewards “Premier” Visa Signature Card

Marriott Rewards “Premier” Visa Signature Card

Chase Ink Bold Ultimate Rewards Card

Chase Ink Bold Ultimate Rewards Card  Chase Ink Plus Ultimate Rewards Card

Chase Ink Plus Ultimate Rewards Card